When you take out a student loan, you agree to certain terms in the promissory note. When you don't meet these terms, it's trouble. The loans go into default.

What triggers a default for a federal student loan? When does a federal student loan go into default?

Federal student loans go into default after 270 days of non-payment. This is a more generous default period that private loans. Private loans typically go into default after 90 days of non-payment.

But don't panic! Student loan default may sound like a financial catastrophe, but you can still bounce back from this.

Here are some strategies for recovering from student loan default, including rehabilitation, consolidation, and other options, both governmental and private:

How Do I Recover from Student Loan Default?

The recovery path after default depends on what type of loan you have defaulted on. Here’s how you can recover from federal loan default and private loan default.

Quick Summary: You can get federal student loans out of default with options like loan rehabilitation, consolidation, and the Fresh Start program.

Federal Student Loan Default

If you have a defaulted federal loan, the Department of Education is actually pretty lenient. The Department of Education offers several options for rectifying the default.

Federal Student Loan Rehabilitation

For Direct and FFEL federal student loans, you need to agree to make some payments to begin the student loan rehabilitation process. You are required to agree, in writing, to make nine voluntary, reasonable, and affordable monthly payments within 20 days of the due date. These nine payments must continue for 10 consecutive months.

What's a reasonable, affordable monthly payment for student loan rehab? Your loan holder will make that monthly payment determination. The payment amount is determined by your discretionary income. That's the amount that your adjusted gross income exceeds 150% of the poverty level for your family size and location.

With 3+ kids, your monthly payment amount may quickly reach $0 per month. I'm speaking from personal experience here!

The monthly payment is a straightforward calculation. The lender calculates 15% of your annual discretionary income, then divides that number by 12 to determine your reasonable monthly payment. Monthly payments can be as low as $5, depending on the borrower’s income.

Good to know: You can rehabilitate Federal Perkins loans too, but you must make a full monthly payment within 20 days of the due date for nine consecutive months. The required monthly payment amount is determined by your lender.

These calculations are similar to the PAYE (Pay-As-You-Earn) calculation.

How to Remove Federal Student Loan Default from your Credit History?

Once your loan is rehabilitated, the default status is removed from your credit history. Note, however, the history of your late payments will remain on your credit report.

Most negative information generally stays on credit reports for 7 years. Bankruptcy, for example, stays on your Equifax credit report for 7 to 10 years, depending on the type of bankruptcy. Closed accounts paid in compliance stay on your Equifax credit report for up to 10 years.

How to Stop Wage Garnishment after Federal Student Loan Default?

Another big consequence of defaulting on your student loans? Wage Garnishment.

One of the consequences of your loan being in default is that your wages may be garnished. What does garnishment mean?

Garnishment means your employer may be required to withhold a portion of your pay and send it to your loan holder to repay your defaulted loan.

Your loan holder can order your employer to withhold up to 15 percent of your disposable pay to collect your defaulted debt without taking you to court. This withholding (“garnishment”) continues until your defaulted loan is paid in full or the default status is resolved.

Garnishment rules and laws can vary from state to state. Check out our state guides to student loans and garnishment here.

After a loan is paid in full, collection of payment through wage garnishment will stop. You also regain eligibility for federal student loan benefits.

Read more about Wage Garnishment options here.

Federal Student Loan Consolidation

Another path out of federal loan default is through a Direct Consolidation loan. A consolidation loan allows you to replace one or more federal loans with a new one.

There are two possible ways to be eligible for consolidation. First option, you can agree to an income-driven repayment (IDR) plan under your new Direct Consolidation loan. Second option, you can make three consecutive, voluntary, on-time, full monthly payments on the defaulted loan prior to consolidation.

Consolidation doesn’t remove the record of default from your credit history, but it does allow you to regain eligibility for federal student loan benefits.

Pay Off the Loan in Full

Paying off your student loan in full is always an option. But not everybody (or hardly anybody) can do it.

Federal student loan borrowers can also get out of default by paying off the loan in full, though this is rarely an option for most borrowers.

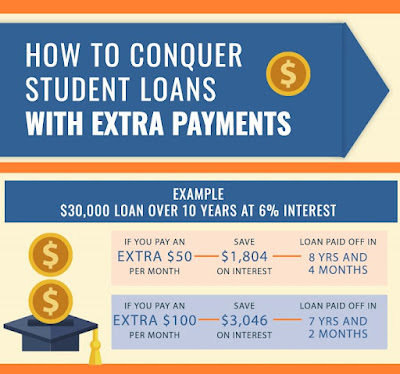

But! There's a middle option. Paying extra each month. The graphic below illustrates how paying a little extra on your student loan every month can shaves off years of debt.

Fresh Start: Government Program to Help Borrowers

The Biden-Harris administration unveiled a new program, dubbed Fresh Start, to help federal loan borrowers in default. This one-time, temporary program is designed to help borrowers recover from the ongoing financial fallout of the COVID-19 pandemic.

The Fresh Start program offers several benefits to federal student loan borrowers in default:

- Renewed access to federal student aid (which is normally closed to borrowers in default)

- Relief from collections will continue after the end of the payment pause

- Restored access to loan rehabilitation if you have already rehabilitated a loan before

- Loans will be reported as “in repayment” to the credit bureaus rather than “in default.”

To sign up for the Fresh Start program, borrowers must contact the Department of Education’s Default Resolution Group.

Private Student Loan Default

Unlike the Department of Education, private lenders don’t have standard procedures for getting out of default. Borrowers must contact their lenders to find out the best way to recover from a defaulted private loan.

No matter who your lender is, however, it’s always best to contact them (or their contracted loan servicer) as soon as you realize you may miss a payment. Your lender can help you figure out a way to avoid defaulting and offer you a path to recover.

Here are some example options offered by lenders:

- MEFA: If you are struggling to pay your private loan with MEFA, you may be eligible for relief options, such as a modified payment plan. The lender recommends borrowers in financial hardship contact the loan servicing provider, American Education Services (AES) by phone at (800) 233-0557 or via their website to offer you relief.

- Sallie Mae: This lender recommends borrowers experiencing financial difficulty to get in touch to discuss options. You can chat with a customer service representative on Sallie Mae’s website or call (800) 472-5543 to find out what relief options are available.

Other Types of Aid

In addition to these default recovery options, there are additional avenues you can explore to help you bounce back from a student loan default. These include:

- Federal Student Aid Information Center: This free service offered by the U.S. Department of Education offers guidance to federal student loan borrowers on signing up for IDR, Public Service Loan Forgiveness, and loan consolidation. The organization even has a default-specific customer service line.

- Legal advice: If you have defaulted on a private student loan, the lender may try to sue you to garnish your wages. Hiring a lawyer who specializes in student loan default may help mitigate the situation and find a mutually agreeable resolution. You can search for a student loan lawyer via The National Association of Consumer Advocates.

- Credit counseling: Meeting one-on-one with a credit counselor from a reputable counseling service can help you create a debt management plan and identify what repayment options will fit in your budget. The National Foundation for Credit Counseling (NFCC) is a non-profit counseling organization that charges clients on a sliding scale and operates nationwide.

What Are the Consequences of Student Loan Default?

The consequences of defaulting on your student loans are severe. They may include:

- Damage to your credit: Even before your student loan enters default, your delinquent payments will affect your credit. Once your loan is marked as in default, it will further hurt your credit score and history.

- Loan acceleration: In many cases, going into default means that your entire loan balance becomes due immediately.

- Loss of benefits: Benefits like deferment and forbearance are only available to borrowers whose loans are in good standing.

- Garnished wages: Federal loans in default can result in garnished tax refunds, federal payments, and even wages. Private loans may go into collections, which can also result in garnished wages, depending on the statute of limitations.

- Lawsuits: Private lenders may sue you for the amount of your defaulted loan, plus their court costs, attorney fees, collection costs, and any other costs they incurred when you defaulted on your loan.

How Can I Avoid Student Loan Default?

Here are the best practices for student loan borrowers to ensure they stay up-to-date on their repayment:

- Complete exit counseling: Federal loans require students who are graduating, leaving school, or dropping to less than half-time enrollment, to complete exit counseling. This requirement may seem like a mere formality, but it is an important opportunity for you to learn and record information you will need, such as your loan servicer contact information, the type of loan you have, your repayment schedule, and the amount you have borrowed.

- Understand your loan terms: It can be easy to assume that repaying your loans is tomorrow’s problem, but make sure you read through your promissory note carefully before signing so you are clear on what will be required of you. If you don’t understand something, ask questions.

- Track your loans online: If you have federal loans, you can track information about all of them at StudentAid.gov. If you have private loans, make sure you know the login portal for your lender or lenders.

- Keep good records of your loans: Keeping a file of important documentation can ensure you don’t lose track of any loans, payments, or other information. You’ll need to keep records of the amount borrowed, student loan account numbers, lender contact information, payment schedules, your monthly payments, and any other paperwork from your lender.

- Contact your lender if anything changes: Alert your lender if your name, address, contact information, or financial situation changes. Your lender must always be able to reach you, and letting your lender know when you are struggling to repay your loan will allow you to work together to create a repayment plan that fits your changed financial circumstances.

Can I Refinance Student Loans in Default?

It’s possible to refinance student loans in default. What does it mean to refinance a loan?

When you refinance a loan, you take out a new loan to pay off the previous loan(s). Refinancing often means reducing your interest rate, monthly payment, or the overall cost of the loan.

The tricky part is qualifying. It may be difficult to qualify for a refinance loan if you have student loans in default, since the default will be reflected in your credit. Applying for a refinancing loan with a creditworthy cosigner may improve your chances of qualifying or even help you get a better rate.

0 Comments